What is a UCC-1 Filing? How Do UCC Liens Work?

UCC-1 Financing Statements are commonly referred to as simply UCC-1 filings. UCC-1 filings are used by lenders to announce their rights to collateral or liens on secured loans and are usually filed by lenders with your state’s secretary of state office when a loan is first originated. UCC-1 filings can either be filed for specific assets—such as a commercial property or piece of equipment—or as a blanket lien covering all of the borrower’s assets. You’ll quickly find that UCC-1 filings are fairly common in the world of small-business lending and are nothing to cause alarm.

What Does UCC Stand for?

UCC-1 Filings Explained

Types of UCC-1 Filings

Typical Collateral

How Does a UCC Lien Affect Your Business? How to Check for or Remove UCC Liens What Does UCC Stand for?

UCC stands for Uniform Commercial Code, which is a set of rules that help govern U.S. business laws on commercial transactions. Technically, the UCC isn’t a set of laws itself but more of a model that individual states follow. Each state has its own implementation of the UCC rules, but the rules don’t vary that much from state to state.

UCC-1 Filings Explained

If you’re approved for a small-business loan, a lender might file a UCC financing statement or a UCC-1 filing. This is just a legal form that allows for the lender to announce lien on a secured loan. This allows for the lender to seize, foreclose or even sell the underlying collateral if you fail to repay your loan.

We highly recommend you research if your lender regularly files UCC-1 filings and requires collateral before applying for a small-business loan. Even if you’re completely confident that you’d be able to repay the loan, we still recommend caution here, as UCC-1 filings can impact your business as we describe in detail below.

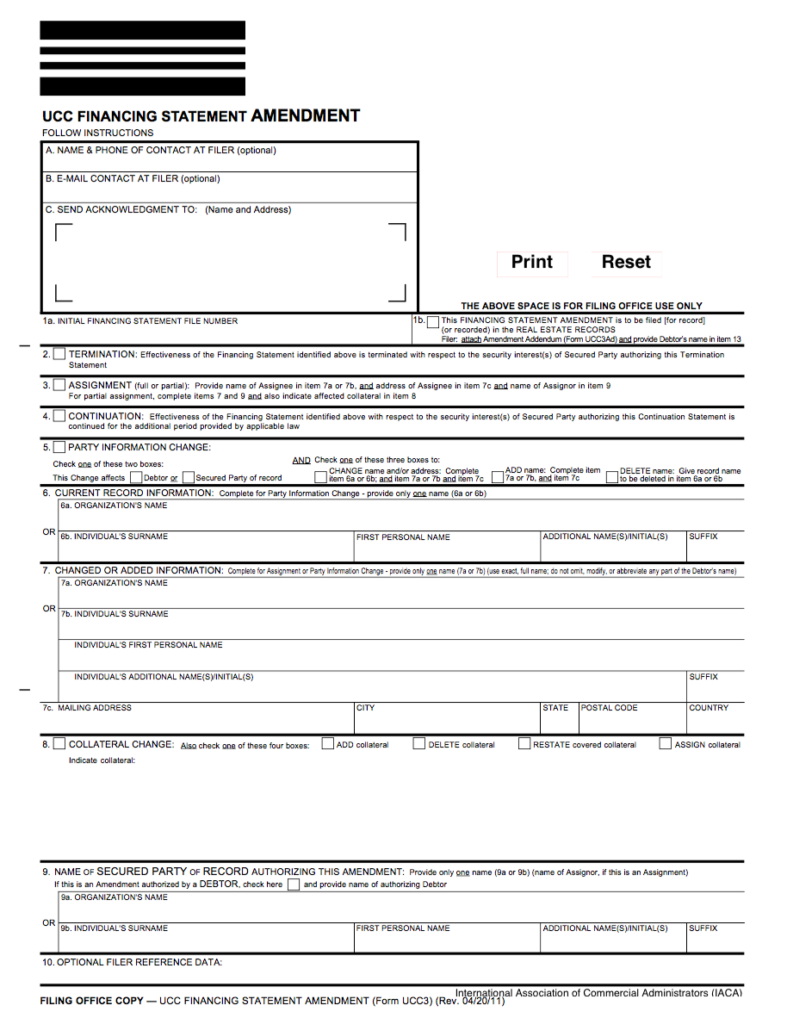

The information on a UCC-1 filing can include:

The creditor’s name and address. The debtor’s name and address. A description of the collateral. Two Types of UCC-1 Filings

UCC liens against specific collateral: This type of lien gives creditors an interest in one or more specific, identified assets rather than an interest in all the assets owned by a business. These are most often used for inventory financing or equipment financing transactions.

UCC blanket liens: This lien gives a creditor a security interest in all assets of the borrower. This lien type is commonly used for loans from banks and alternative lenders, as well as loans

guaranteed by the Small Business Administration (SBA). Blanket liens are preferred by lenders, because they are secured by multiple assets and are, therefore, less risky. In some cases, a blanket lien might carve out some assets that will be exempt from the lien. This might occur if the remaining assets are more than sufficient to reimburse the lender, should a default occur.

Typical Collateral

UCC-1 filings typically use moveable assets as collateral, which can include vehicles, office equipment and fixtures, investment securities, inventory, receivables, letters of credit, and other tangible items of value.

For example, if you take out a loan to buy new machinery, the lender might file a UCC-1 lien and claim that new machinery as collateral on the loan. You would, of course, work with your lender to designate what the collateral will be before you sign any documentation committing to the loan. If you sign a secured loan, all of the designated collateral is now the property of the lender until your loan is fully repaid. Your lender can seize that collateral if you fail to repay your loan.

When a lender files a UCC-1 with the appropriate secretary of state—meaning the secretary of state for your residential state, or the state where your company is incorporated or organized— the lender is said to “perfect its security interest.” Legally, this means the lender can enforce the lien in a state court with minimum fuss. In cases where the collateral is tied to a specific physical property rather than financial assets, the UCC-1 is filed in the county where the physical property is located. The UCC-1 becomes a public record, allowing potential creditors to see whether a given property is already pledged against an existing lien.

When is a UCC-1 Filed?

UCC-1 filings typically happen when a loan is first originated. If the borrower has loans from more than one lender, the first lender to file the UCC-1 is first in line for the borrower’s assets. This motivates lenders to file a UCC-1 as soon as a loan is made. The first UCC-1 filer holds a first-position lien, the second filer has a second-position lien and so forth. Usually, the first- position lien must be completely satisfied before the second-position lien holder can receive any remaining collateral. In some cases, multiple lenders might work out an arrangement that leaves more collateral for junior lien holders. However, lenders typically will not allow a borrower to re- use the same collateral for multiple loans.

We stress that we don’t recommend that you stack your debt and borrow from multiple lenders at the same time, unless your business absolutely needs it. Most lenders will require UCC-1 filings and collateral in order to secure their loans, and you don’t want to spread your assets across multiple lenders. In the event where you cannot repay your loans, significant portions of your personal and business assets would be seized in those cases.

How Does a UCC Lien Affect Businesses?

UCC liens typically have a five-year term, after which they must be renewed by the lender if your loan is still active. A UCC lien can affect your business in three ways:

Prevents additional borrowing: Most small businesses have limited assets to offer as collateral. Lenders know this and usually won’t offer additional financing to companies with an existing

blanket lien until the lien is removed. They don’t want to be fighting for scarce assets with other lenders in case you default.

Borrowers facing this problem can try to get a carveout on the blanket lien and free up some of their secured assets to use as collateral for additional loans, but doing so successfully is pretty rare. One alternative is to refinance with another lender by paying off the first lenders, terminating the original lien and getting a larger secured loan from the second lender. However, there aren’t many lenders willing to finance unsecured loans. Another last resort option is find another lender to take a second-position lien. Again, we don’t recommend debt stacking.

Having an active UCC-1 filing can make things difficult if you’re looking to take out subsequent loans. One thing to keep in mind is that lenders don’t actively terminate UCC-1 liens when those loans are repaid, so it’s your responsibility as the borrower to make sure they do. Luckily, this process is simple, and all you have to do is request your lender file a UCC-3 termination with your last loan payment. This will remove the UCC-1 lien and free you up for other loans.

Impacts business credit report: Your credit report will show all UCC liens for the past five years, including status, collections and disputed amounts. The existence of a UCC lien won’t hurt your credit score unless you’ve defaulted on a loan or it has gone to collection. The loan secured by a UCC lien increases your credit utilization ratio, which could hurt your credit score if the ratio increases too much. However, as long as you’re careful about the size or your loan and responsible with payments, the lien itself shouldn’t affect your score.

Risking pledged assets: A UCC lien puts your business’ assets at risk if you default on your loan. A UCC blanket lien allows the lender to sue for all company assets.

How to Check for or Remove UCC Liens

Doing your due diligence and checking for any UCC liens before applying for a loan is highly recommended. You can do this by going to the website of your state’s secretary of state. The roster of secretaries is listed here. You can also use a commercial UCC search engine such as the one offered by CSC Global.

Having a UCC-1 filing or lien tied to your name or business isn’t necessarily a bad thing. It’s simply a public record stating that a lender has the rights to certain assets until that loan is repaid. That record will also show if the loan has been repaid or not. However, we’ve shown above that an active UCC-1 lien can make it difficult to qualify for other loans even if you’ve already repaid your debt.

Removing a UCC-1 Filing

There are a few ways you could remove your UCC-1 filing:

Pay off your loan: This is the surest way to have the UCC-1 filing removed. Depending on the state, the financing statement usually remains in your state’s searchable index for one year after the loan is repaid. In that case, the statement would reflect that the loan is repaid.

Request a UCC-3 Financial Statement Termination: You should request the lender to file a UCC-3 termination, since lenders typically don’t file these unless requested. You should always

get confirmation from the lender that the UCC-3 was filed. This amendment can remove the UCC lien if processed.

We recommend you request your lender submit a UCC-3 with your final loan payment. Since UCC-1 filings automatically lapse after five years, lenders usually won’t bother filing UCC-3s to actively terminate a UCC-1 lien.

An Example of a UCC Lien Filing

To illustrate, let’s say you own a coffee shop in New York and want to take out a loan to buy a newer, faster espresso machine to keep up with demand. If you secure equipment financing, the lender will file a UCC lien to state that if the debt for the espresso machine is not repaid, the lender has the right to repossess the espresso machine or seize other assets from your business. While you’re still paying off the espresso machine, the machine itself will serve as collateral for its financing, and it will have a UCC filing on it until you repay your equipment financing debt in full.

So, let’s say, for instance, that you want to access additional financing while you’re still paying your equipment financing down. When you apply for new financing, you won’t be able to offer up your espresso machine as collateral. Potential lenders you apply to will perform a New York UCC search and see that your equipment financing lender has already laid claim to it until you repay your equipment financing in full.

The UCC-1 Financing Statement is filed to protect a lender’s or creditor’s security interest by giving public notice that there is a right to take possession of and sell certain assets for repayment of a specific debt with a certain debtor. This kind of security agreement might be a prerequisite for a lender to loan money to your business, and establishes the terms of the lien that the lender will acquire on the property of the debtor in the case of default or bankruptcy.

We can file your UCC for all of your commercial needs to protect your investment. Inquire within for more details and pricing.